The Counter-Strike 2 skins market is experiencing its most dramatic crash of 2025 — over the past 24 hours, its total capitalization has dropped by nearly $400 million. Analysts, traders, and everyday players are trying to figure out: is this a normal correction, or the beginning of a prolonged digital asset crisis within CS2?

A Historic Drop: The Scale of the Losses

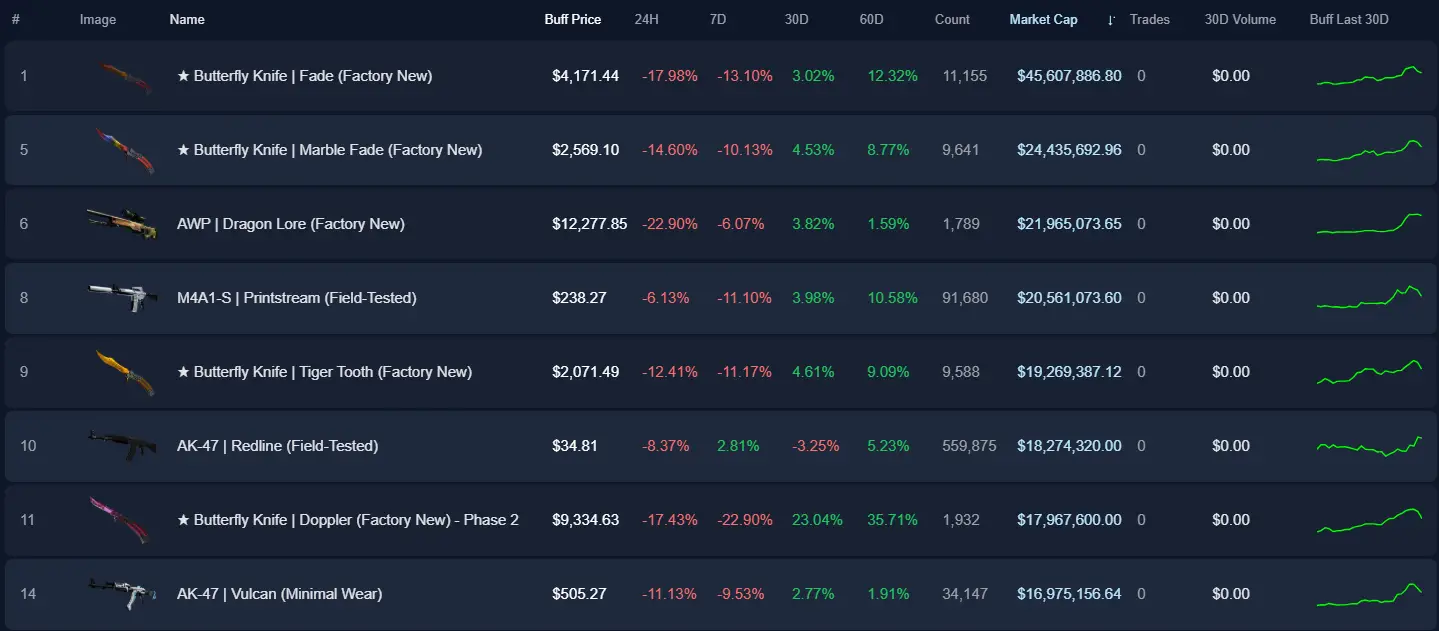

According to analytics platform PriceEmpire, the total market value of CS2 skins dropped from approximately $4.5 billion to $4.1 billion in less than a day. To put that into perspective, it’s the equivalent of:

- the entire inventory value of over 1 million players, assuming an average value of $400 per account;

- or nearly all of Valve’s annual earnings from Major tournaments.

This is the sharpest single-day decline since the release of CS2 in 2023.

What Caused the Crash? Key Factors

1. Accumulated Market Overheating

Prices of rare skins — especially knives, gloves, AWP Dragon Lore, AK-47 Fire Serpent, and others — had been surging since late 2023. At their peak in spring 2025, even basic cases were trading for $3–5 each. This created a bubble effect that was bound to burst.

“The market was living in a parallel reality. A Dragon Lore for $15,000 — that’s unreasonable, even for a hardcore collector.”

— trader @CS2Economist

2. New Case Releases

Valve recently released another batch of cases with flashy new skins. This prompted many traders to sell older items in order to invest in the new ones. The market became oversaturated, and the value of “classic” skins started to decline.

3. Security Concerns

Rumors began circulating online about potential exploits involving item duplication or inventory manipulation. Even if exaggerated, the mere fear of instability triggered a massive sell-off.

4. Broader Financial Correction

Some traders had been treating CS2 skins as a store of value or even an investment vehicle. But with the crypto market cooling and growing economic instability worldwide, many investors started pulling money into more tangible assets.

Community Reaction: Panic, Irony, and Hope

Panic has broken out on Reddit, Twitter, and Discord trading communities. Players who invested thousands of dollars into skins are now watching their “virtual capital” evaporate.

“My Butterfly Fade dropped from $2,300 to $1,800 in 10 hours. And it’s still falling.”

— Reddit user u/SkinTycoon

Others are taking the situation with a dose of dark humor:

“It’s like crypto, but with more pixels and no blockchain.”

— comment from r/GlobalOffensiveTrade

Context: Is the Skins Market Even That Serious?

Yes — the CS2 skins market is considered one of the largest secondary digital item markets in the world, alongside cryptocurrency, NFTs, and in-game economies from titles like Dota 2, Fortnite, and other AAA games. Since CS:GO’s release in 2012:

- Over 500 million cases have been opened;

- More than 1 million trading accounts have been created;

- The combined inventory value surpassed $5 billion in April 2025.

This ecosystem is supported by dozens of platforms — from marketplaces (Buff, Skinport, CS.Money) to analytics tools (PriceEmpire, Sharkbay).

What Happens Next?

There are two likely scenarios:

Optimistic:

After the hype burns off, the market stabilizes. Players return to long-term investing, and prices gradually climb back up following new updates and case releases.

Pessimistic:

Trust is deeply damaged, trading volume drops, and the market enters a prolonged recession.

Much will depend on Valve’s next steps — whether they release new content, maintain a healthy in-game economy, and continue to fuel community interest in collecting.

Advice for Traders

- Don’t sell in panic. Just like on stock markets, panic always works against you.

- Watch the trends. Follow updates from PriceEmpire, HLTV, and trusted community channels.

- Invest in uniqueness, not hype. Rare skins from older collections are more likely to recover in value over time.

The CS2 skins market may be going through a crisis now, but its long-term history shows one thing clearly: it has fallen before — and always found a way to bounce back.

This time, however, the stakes are higher than ever.